Levelling Up Equal Access to University Education

100,000 British students have already been directly disadvantaged to date since £9,000 annual fees were introduced a decade ago, with 10,000 students continuing to be impacted each year.

Please support our campaign to lobby the government to urgently introduce Alternative Student Finance so the life changing opportunity of receiving a university education is not denied to another generation of British Muslim students.

Why is this important?

Student Loans Charge Interest

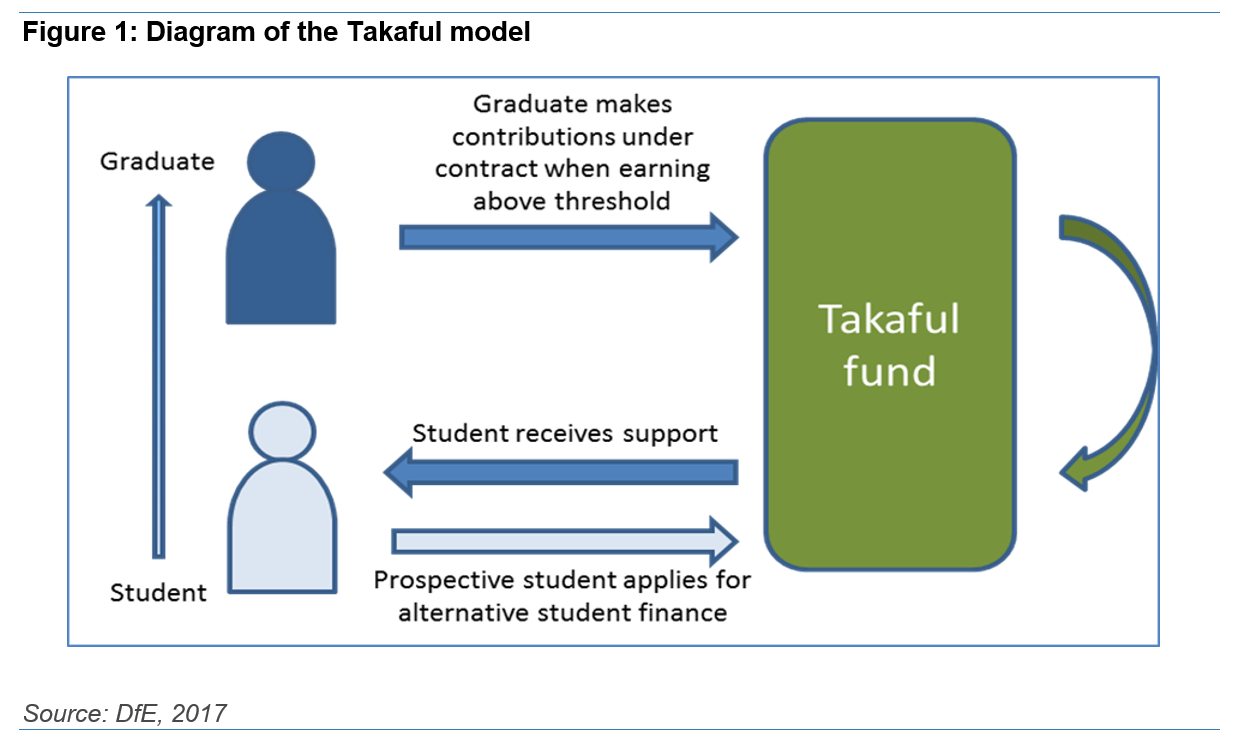

Paying or receiving interest is something many Muslims consider to be scripturally prohibited. This prohibition results in many Muslims deciding either to forgo attending university or being forced to self fund to try make ends meet. The Alternative Student model, which was developed by the government many years ago, mirrors the charges and terms of existing student loans but through an underlying process which does not use interest.

In addition to this, the lack of equal access to higher education is felt more keenly by the Muslim community as its has a relatively higher-than-average younger population. 48% of British Muslim community is under 24 years old (compared to 31% of the overall population as per official labour market stats). For many of their peers, pursuing higher education is one of the most common routes of aspiration, progression and development for them (86% of domestic university students are aged 24 or under).

What the Politicians Said

"Never again should a Muslim in Britain feel unable to go to university because they cannot get a Student Loan- simply because of their religion." David Cameron - then Prime Minister

"Muslims are missing out on university and Muslim young people are left to struggle and wrestle over the conflict between what they believe in and their hopes for university study. As the Government recognised eight years ago, our system should not be doing that to people." Stephen Timms MP - Chair, Work and Pensions Committee

"I first raised this issue with Ministers in January 2016 and have raised it frequently since. Sharia law forbids interest-bearing loans. That prohibition is a barrier to Muslim students attending our universities and has been a problem since 2012. Successive Governments have known about this problem and have recognised that the current system effectively discriminates against devout Muslims." Lord Sharkey - Life Peer of the House of Lords

We're getting there!

What's Happened So Far?

The campaign started in 2013 after university tuition fees were tripled from £3000 to £9000- significantly increasing the financial barrier to entry for higher education.

By working together we managed to:

- Establish the issue on the political map with even the Prime Minister David Cameron acknowledging the importance of Alternative Student Finance in 2013.

- Conducted a consultation on a Takaful structure for the Alternative Student Finance which ended in June 2014. The consultation ranged across nearly 20,000 people and it was concluded that it would be achievable by 2016 (however this was not achieved as the Secretary of State for Education had not been granted the power to offer an Alternative Student Loan).

- In March 2017, Lord Sharkey proposed a deadline of the 2018-19 academic year. Though this narrowly lost, the Government reaffirmed that they would make it available as soon as practicable.

- In April 2017 the Secretary of State for Education was finally given the power to offer an Alternative Student Loan.

- In 2019 we published a research report to emphasise the impact of the current system on Muslims and the choices it forces them to make.

- January 2021, the Universities minister stated: "The government is committed to ensuring that all students with the potential to benefit from further and higher education are able to access it. The government will provide a further update on the Alternative Student Finance product in due course".

- April 2021, Lord Sharkey tried to impose a 6 month deadline through Parliament. It wasn't successful.

- We held this Webinar in May 2021.

- In July 2021 an adjournment debate with the Universities Minister was held in the House of Commons.

- In October 2021, the Muslim Census concluded on a survey that involved over 35,000 people. Their article on the results noted that the demand for an Alternative Student Loan remained high and that there was an ongoing and real human cost of the delay.

- We ran a petition that achieved 30,000 signatures and in October 2021 we delivered this letter to the Prime Minister.

- Ministerial meeting was held in September 2021 to keep this on the political agenda.

- This website was launched in January 2022 to pull all the hard work so far together and act as a staging point to channel our collective will and efforts.

2022 - time for our community to push this over the line

Coverage

Tips for how to self-fund your studies currently

1. There are various grants and bursaries you can apply for such those offered by NZF, Aziz Foundation, and Ansar Finance. See a complete overview in this IFG article.

2. Plan productive gap years (either before or during studies) to build up skills and save. Freelancing jobs are also an option whilst working.

3. Check university websites and reach out to them to discuss if they can provide financial assistance or a bursary.

Read more ideas in this article.

Who are we?

A not-for-profit collective of organisations

Students and activists

The lifeblood of the movement. Everyday superstars that feel passionately about ensuring Muslims have access to Higher Education without compromising their values. Count yourself in by signing up below.

IslamicFinanceGuru

IFG is a hub that helps Muslims with their investment, personal finance and entrepreneurial journeys. We do this for one reason: to make our community better-off. Check them out here.

BBSI

BBSI is a national assembly of Imams, Scholars & Islamically literate Muslim Academics formed to facilitate intra Muslim dialogue on theology, jurisprudence and community welfare. Check them out here.

National Zakat Foundation

NZF is the only platform that receives Zakat and distributes it to thousands of Muslims in need across the UK. Check them out here.

Muslim Census

Muslim Census is an independent organisation committed to collecting representative data, to highlight issues faced by the UK Muslim community. Check them out here.

Get involved!

By working together we've put this on the political agenda. With your help, we'll get Alternative Student Finance over the line.

1. Write to your MP to put tell them this matters to you (click here and we'll help you with the letter).

2. Collaborate with us- click the button below to let us know how you can get involved!

3. Join us in bringing attention to this issue with #equalaccesstouni

-p-800.jpeg?width=164&height=109&name=607318a1dff99a55a5dada4a_Website%20Images%20(35)-p-800.jpeg)